How Misunderstandings About Affordability Could Cost You

Reposted Blog from Keeping Current Matters 5/27/2021

There’s a lot of discussion about affordability as home prices continue to appreciate rapidly. Even though the most recent index on affordability from the National Association of Realtors (NAR) shows homes are more affordable today than the historical average, some still have concerns about whether or not it’s truly affordable to buy a home right now.

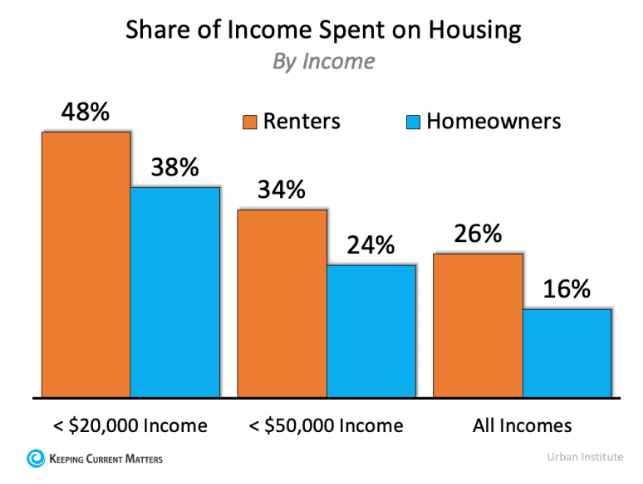

When addressing this topic, there are various measures of affordability to consider. However, very few of the indexes compare the affordability of owning a home to renting one. In a paper just published by the Urban Institute, Homeownership Is Affordable Housing, author Mike Loftin examines whether it’s more affordable to buy or rent. Here are some of the highlights included.

- Renters pay a higher percentage of their income toward their rental payment than homeowners pay toward their mortgage.

“When we look at the median housing expense ratio of all households, the typical homeowner household spends 16 percent of its income on housing while the typical renter household spends 26 percent. This is true, you might say, because people who own their own home must make more money than people who rent. But if we control for income, it is still more affordable to own a home than to rent housing, on average.”

- Renters don’t have extra money to invest in other assets.

“Buying a home is not a decision between investing in real estate versus investing in stocks, as financial advisers often claim. Instead, the home buying investment simply converts some portion of an existing expense (renting) into an investment in real estate.”

It explains that you still have a housing expense (rent payments) even if you don’t buy a home. You can’t live in your 401K, but you can transfer housing expenses to your real estate investment. A mortgage payment is forced savings; it goes toward building equity you will likely get back when you sell your home. There’s no return on your rent payments.

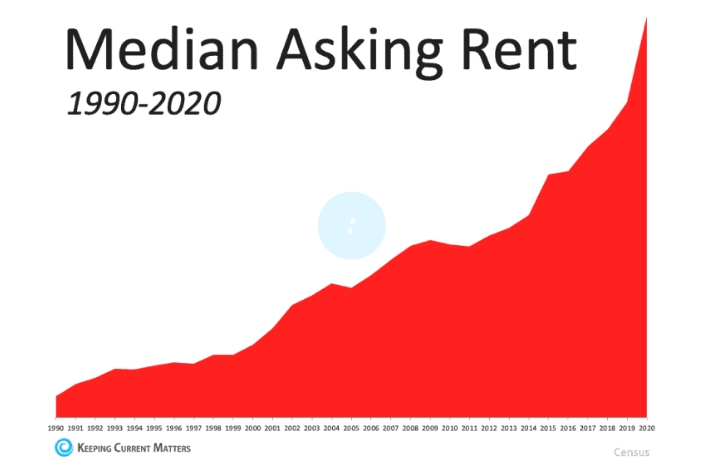

- Your mortgage payment remains relatively the same over time. Your rent keeps going up.

“Whereas renters are continuously vulnerable to cost increases, rising home prices do not affect homeowners. Nobody rebuys the same home every year. For the homeowner with a fixed-rate mortgage, monthly payments increase only if property taxes, and property insurance costs increase. The principal and interest portion of the payment, the largest portion, is fixed. Meanwhile, the renter’s entire payment is subject to inflation.

Consequently, over time, the homeowner’s and renter’s differing trajectories produce starkly different economic outcomes.

Homeownership’s major affordability benefit is that it stabilizes what is likely the homeowner’s biggest monthly expense, assuming a buyer has a fixed-rate mortgage, which most American homeowners do. The only portion of the homeowner’s housing expenses that can increase is taxes and insurance. The principal and interest portion stays the same for 30 years.”

A mortgage payment remains about the same over the 30 years of the mortgage. Here’s what rents have done over the last 30 years:

- If you want to own a home and can afford it, waiting could cost you.

“We need to stop seeing housing as a reward for financial success and instead see it as a critical tool that can facilitate financial success. Affordable homeownership is not the capstone of economic well-being; it is the cornerstone.”

Homeownership is the first rung on the ladder of financial success for most households, as their home is most often their largest asset.

Bottom Line

If the current headlines reporting a supposed drop-off in home affordability are making you nervous, contact your local real estate professional for the real insights into your area.