Before you read this blog, I want you to know that there is a solution

to help buyers with the increased interest rates. Read the 2-1 Buydown blog in Buyer Info on REX2020.com.

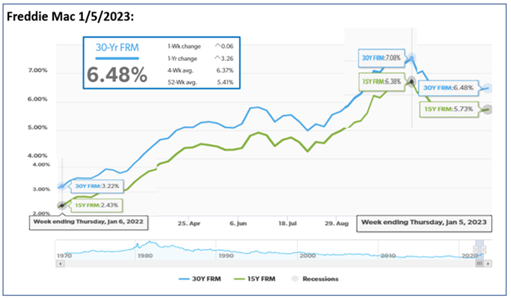

The 2022 interest rate story has been a tough one for buyer to understand. Rates more than doubled in the course of the year. Buyer’s, in some cases have lost 30% of their buying power. Mortgage Rates: 3.22 in January, 7.08% in September and 6.48 at the end of the year.

What does this mean? The principal and interest payment (Pi) for a $1M purchase with 20% down at

3.5% has a Pi payment of $3,592 – 7% has a Pi payment of $5,322 – 6.5% has a Pi payment of $5,057

Every 1% increase or decrease in the mortgage interest rate will affect the buyer power by about 10%.

A 10% increase or decrease in the monthly payment.

A 10% increase or decrease in the home price the buyer can afford.

Let’s Look at the effect the interest rate increase had on Bob:

In January Bob was approved for a loan to purchase a $1M home at 3.5% has a Pi payment of $3,592. This price was at the top of his approval based which was based on his credit score and debt to loan. He was excited but had other things on his mind and decided to wait.

In August after a great Western European cruise, he decided he better get on it as prices and interest rate were climbing.

Bob called his lender to see if he needed to deliver any additional information as he was ready to start looking. Of course, the lender gave Bob the bad news. I need to run your numbers again because the interest rates are up.

While Bob was on his cruise, interest rates were 5.75%. Bob’s lender ran the numbers and told Bob he is nor approved for a loan amount of $615,520. Add the 20,000 bob has for down payment and he can buy a $635,000 home.

As if that news was bad enough, Bob’s REALTOR® helped him find homes in his new price point which caused initial disappointment. OK, he had to settle for a smaller home, a bit older and further away from his initial target, but he did find a great home.

But the rest of the story is a tough pill to swallow. Appreciation and depreciation of home values adds an additional effect on the home Bob gets to buy. We will explore that in a separate blog.

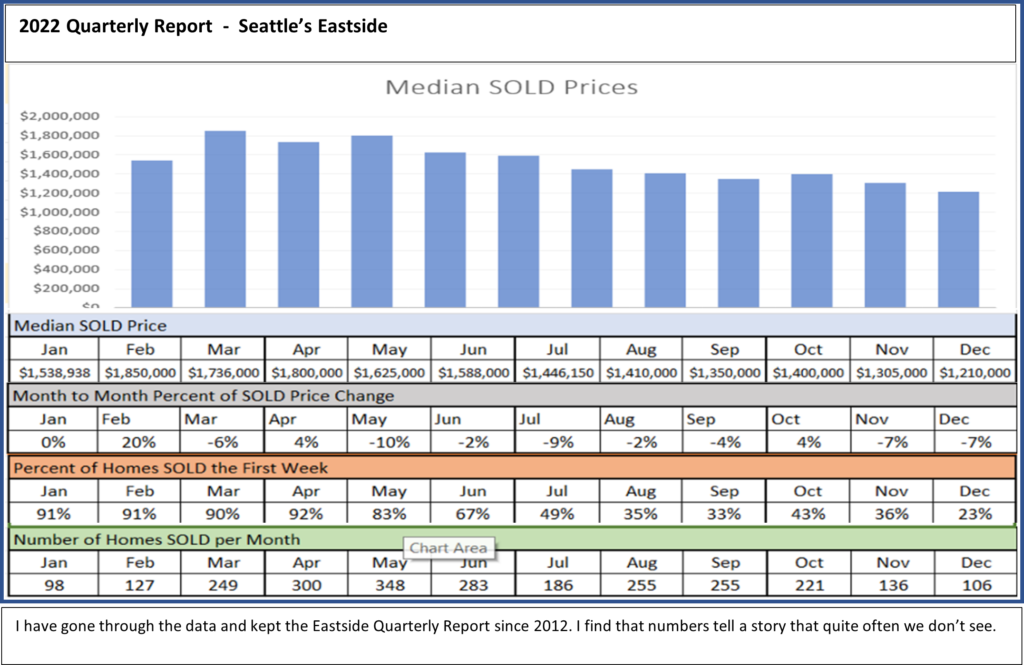

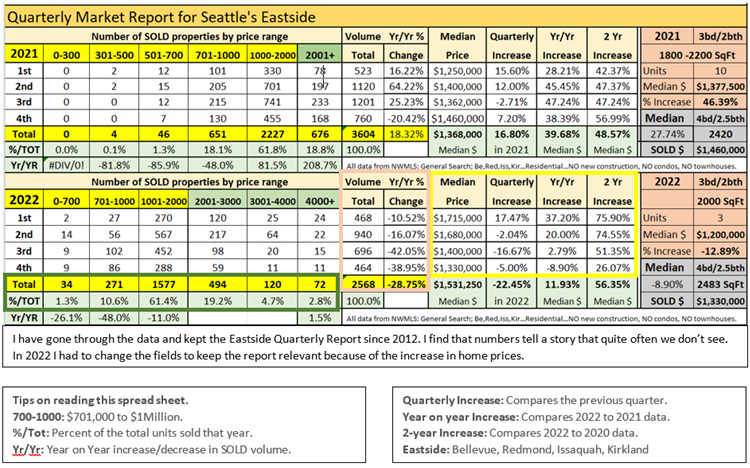

2022 – The Year In Review

Leave a comment below if you have been thinking about a move and have any questions …

Check REX2020.com for more blog posts and information about the market and strategies for sellers and buyers. This information is valuable and timely for today’s real estate market.

While on my website, you can see my step-by-step processes for Sellers and Buyers. Both are based on the current market and proven by my years of experience. Whether it’s time to buy now or in the future, you will receive options that will help you to put a plan of action in place. Contact Tom Directly

Not all agents are REALTORS®. We are held to a higher standard. Beyond the education, we are held accountable to the Code of Ethics. Always ask, “Are you a REALTOR®?”