As we see mortgage interest rates increase so quickly, the buyer pool in every price range moves down the ladder. Keep in mind that an interest rate increase of 1% reduces the buyer’s buying power by 10%. This means that a borrower that could comfortably afford a $1M property before the increase, can now only qualify for a $900,000 home unless they stretch their ratios.

Some buyers are either financially forced to look at lower priced homes or they just quit looking out of frustration. As a possible solution, sellers can offer a temporary interest rate buydown to the buyer.

Buyers Save Thousands in the First 2 Years of the Loan

Contact your lender to get more information.

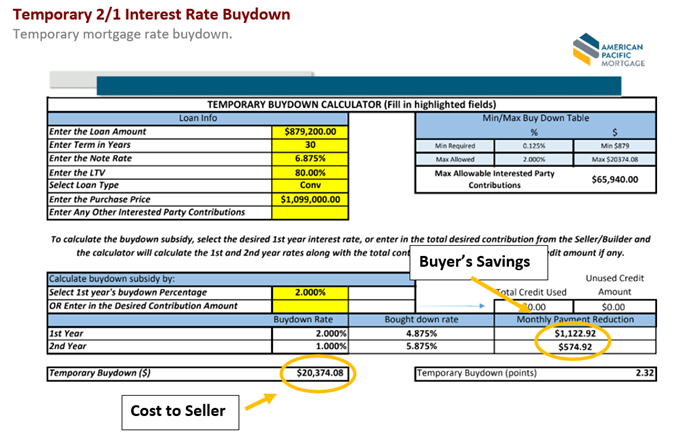

The mechanics behind the Temporary Buydown are quite simple:

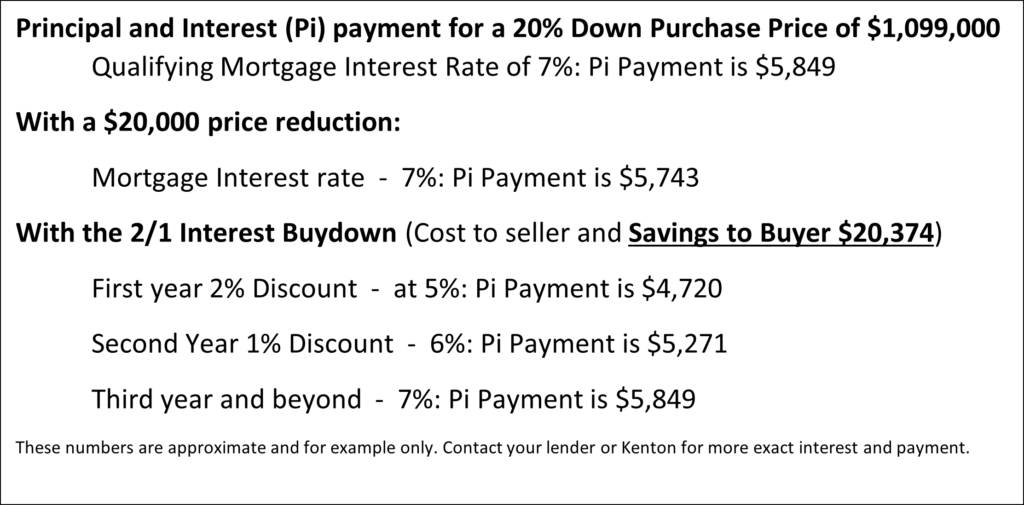

- Buyer still applies and qualifies for the loan at current interest rate… Example 7%.

- Because the seller pre-pays a portion of the buyer’s interest for the first two years at closing…

- The buyer enjoys a 2% rate discount for the first year of the mortgage… Example 5%.

- The rate discount is 1% for the second year of the mortgage… Example 6%.

- For the 3rd and remainder of the loan, the interest rate will remain 7%.

Are there any additional restrictions?

- NO! The buyer must qualify for the purchase loan and the loan must close per the terms of the agreement

How Does a Temporary Buydown a benefit to the buyer?

- This option allows the buyer to comfortably stretch their income ratios.

- Buyer can refinance in a two years when rates have gone down.

- With a full price offer on this property, the buyer can save approximately $20,000.

Contact your lender or my trusted lender to find the actual cost, benefit, availability, and any restrictions.

Kenton Becker – American Pacific Mortgage: 206-423-2552 [email protected]